Wrap Up Your Loose Ends

- npabliss

- Jan 7, 2019

- 1 min read

Updated: May 24, 2019

Look Back Before You Jump Too Far Forward

Cheers to the New Year!

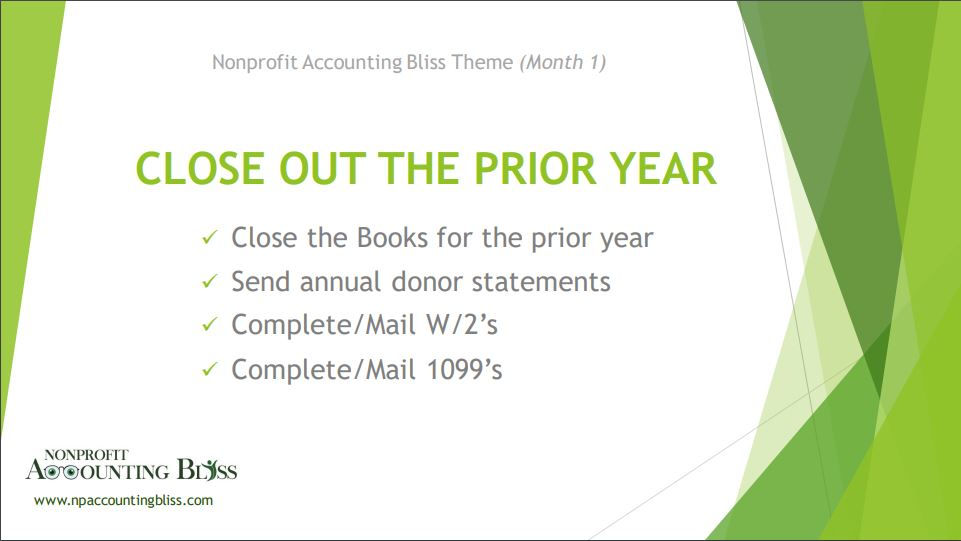

January is a busy month for nonprofits as we close our books for the prior year, send annual donor statements, issue W/2’s to employees and mail 1099’s to our contractors. The clock is ticking and it’s time to get busy with all of these legal compliance matters.

Remember, thanking donors and sending tax forms to your employees and contractors is a time-sensitive priority this month. They’re all due by January 31st!

Let’s get busy and Happy Accounting!

P/S

For those nonprofits needing a little refresher about written acknowledgements, the IRS Publication 1771 below shares more detail starting on page 4:

![Deadlines are Fast Approaching [Demo - Month 1]](https://static.wixstatic.com/media/142c6a_2ebf4bc7dea646b8a8b2a35abefd26e0~mv2.jpg/v1/fill/w_960,h_540,al_c,q_85,enc_avif,quality_auto/142c6a_2ebf4bc7dea646b8a8b2a35abefd26e0~mv2.jpg)

![Intentional Accounting in 2020 [Checklist Included]](https://static.wixstatic.com/media/142c6a_149f640f12a3491cba1de02991464861~mv2.jpg/v1/fill/w_443,h_327,al_c,q_80,enc_avif,quality_auto/142c6a_149f640f12a3491cba1de02991464861~mv2.jpg)

Comments